Buying vs. Financing Manufacturing Equipment

As a business owner or manager of a manufacturing company, one of your primary goals is to meet your clients’ needs while remaining competitive in the market. This often involves purchasing or upgrading equipment to improve productivity, reduce costs, or enhance product quality. The cost implications, however, can be quite significant, leaving you to contemplate the merits of buying versus financing manufacturing equipment.

To get started, explore the latest innovations in the equipment you need. If you haven’t brought a new machine in several years, you may find there are many new features. These could include improvements in speed, usability, safety, and versatility in the materials the machine can handle.

Machines may also have grown larger or become more compact. Assess your space and your manufacturing needs, and make a list of the equipment you want to add before you look into whether buying or financing is the best option for you.

Considering the main benefits, drawbacks, and financing options for manufacturing equipment will help you determine the best course of action for your situation. You must take into account cash flow, business duration, tax implications, and trade-in or sale value.

Understanding the Difference: Buying vs. Financing

In addition to an outright purchase, there are two other common forms of paying for manufacturing equipment: leasing and loans. Leasing involves an agreement to rent the equipment for a specific period, with the option to purchase it at the end of the lease term. Loans generally involve borrowing a sum of money to purchase the equipment, which you pay off over time with interest. In contrast, buying outright is using your own capital to purchase the equipment.

Buying and financing have advantages and disadvantages, depending on your business needs and the industry it operates in.

Benefits of Financing Manufacturing Equipment

The benefits of financing manufacturing equipment could include the following:

Cash Flow

By financing, you can allocate your capital to other areas of your business, like hiring employees, marketing, or expanding facilities. Financing allows you to obtain the necessary equipment without significantly impacting your cash flow.

Tax Benefits

Depending on the finance agreement, monthly payments may be tax deductible as a business operating expense, reducing your tax liability. Be sure to check with your tax advisor before you finance and before you file your taxes about whether you can take advantage of such deductions.

Equipment Currency

Leasing may facilitate upgrading to newer or more advanced equipment when your lease term expires. In some industries, new technology comes online frequently, while in others, older equipment can serve perfectly well for years on end.

Increased Flexibility

Lenders who make loans for manufacturing equipment may tailor financing options to your specific needs regarding repayment and purchasing options.

Disadvantages of Financing Manufacturing Equipment

While financing offers noteworthy benefits, you must be aware of some drawbacks:

Long-Term Cost

The total cost of leasing or loan repayment may exceed the initial purchase price due to interest and fees.

Ownership

With leasing, you will not own the asset unless you buy the equipment at the end of the term.

Contractual Obligations

Financial agreements may have clauses that restrict your ability to modify the equipment or impose penalties for early terminations.

Differences by Industry

The advantages and disadvantages of buying versus financing manufacturing equipment can differ significantly by industry. In industries where technology rapidly evolves, having the ability to easily upgrade with financing options may be more beneficial.

Loans or leases may also be advantageous when the equipment’s trade-in or sale value is low. Conversely, for industries with more stable technology and high trade-in values, purchasing outright might be a more cost-effective solution.

More About Financing Options for Manufacturing Equipment

There are several different financing structures in addition to leasing or loans against the value of the equipment you’re financing. These may include:

- Line of credit: a flexible credit facility that allows you to draw on funds up to a specified limit for equipment purchases.

- Asset-based loans: a loan secured not against the equipment financed but against one or more of your other assets, such as inventory or accounts receivable, to finance equipment purchases.

- Small business administration loans: government-backed loans that can help finance large equipment purchases if your business qualifies.

- Vendor financing: financing provided directly by the equipment manufacturer or vendor.

- Personal loans: a loan using personal credit and assets to finance equipment purchases.

Balancing the Pros and Cons

When deciding whether to purchase or finance manufacturing equipment, consider the following factors:

Cash Flow

Determine how much capital you can allocate to purchasing equipment without impacting other critical areas of your business.

Duration of Business

Buying outright may be more beneficial for an established company with strong cash reserves and deep industry knowledge. For a start-up or a company with a short operating period, financing may be the more practical option.

Tax Implications

Consult with your accountant or tax adviser on the benefits of leasing versus buying, as tax deductions will differ based on your chosen method.

Trade-in or Sale Value

When considering financing options, evaluate the equipment’s anticipated trade-in or sale value to determine whether you should purchase or lease.

Financing options are some of many important factors to consider when choosing a vendor for manufacturing equipment. You should also consider service and repair, the availability of replacement parts, and the vendor’s ability to help train employees on new and upgraded equipment.

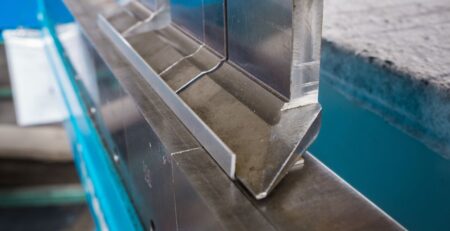

For example, suppose you’re bringing a CNC fiber laser cutting machine into your metal fabrication shop for the first time. In this case, operators not familiar with such equipment will need operational and safety training by experts in the machine’s mechanisms. Staff may also need upgraded safety equipment, including personal protective gear.

Some equipment may require modifications on your manufacturing or fabrication floor. These could include improved ventilation, heat shielding, and increased space for robotic operations.

Working with an experienced vendor with a strong reputation for outstanding customer service will benefit your business. A company with availability for training, parts, and repair will help make financing new equipment worth the expense, paperwork, and financial commitment.

Ultimately, your decision should be based on your business goals, financial standing, industry conditions, and equipment needs. By weighing the pros and cons of all options and exploring financing alternatives, you can make a wise investment that benefits your business’s growth and longevity. You should consult with professionals, including lenders, financial advisers, and equipment experts, to make an informed decision that aligns with your business plan.